How Can I Claim My ADA Tax Credit?

How To Claim Your ADA Tax Credit: A Step-by-Step Guide

The Americans with Disabilities Act (ADA) is not just a landmark civil rights law; it also offers financial incentives for businesses that make their premises accessible to people with disabilities. One such incentive is the ADA Tax Credit, which can reduce your tax liability and help offset the costs of accessibility improvements. Here's a step-by-step guide on how to claim your ADA Tax Credit.

Understanding Eligibility

Who is Eligible?

The ADA tax credit, also known as the Disabled Access Credit, is available to small businesses that incur expenses for making their facilities accessible to individuals with disabilities. To be eligible for this tax credit, businesses must have either gross receipts of $1 million or less in the previous tax year or employ 30 or fewer full-time employees. This credit can be claimed for expenses incurred in removing barriers and providing accessibility features such as ramps, widened doorways, accessible parking spaces, and accessible restrooms.

Understanding the Americans with Disabilities Act (ADA)

The ADA tax credit is designed to incentivize small businesses to improve accessibility for individuals with disabilities. By providing a tax credit, the government aims to encourage businesses to make their facilities more inclusive and accessible. This not only benefits individuals with disabilities but also opens up opportunities for businesses to tap into a larger customer base. It is important for businesses to understand the eligibility criteria and take advantage of this tax credit if they meet the requirements.

Qualifying Expenses

Some qualifying expenses for ADA tax credit include the costs associated with making physical modifications to a business or commercial property to ensure accessibility for individuals with disabilities. This can include installing ramps, widening doorways, modifying restrooms, and creating accessible parking spaces. These modifications must meet the requirements outlined in the Americans with Disabilities Act (ADA) guidelines to be eligible for the tax credit.

Adaptive Equipment and Assistive Technology

Another qualifying expense for ADA tax credit is the purchase of adaptive equipment or assistive technology that enables individuals with disabilities to perform essential job functions. This can include items such as specialized computer software, ergonomic furniture, hearing aids, or communication devices. The equipment must be directly related to accommodating an employee's disability and must be necessary for them to perform their job duties effectively.

Auxiliary Aids and Services

Additionally, expenses related to providing auxiliary aids and services to individuals with disabilities may qualify for the ADA tax credit. This can include the cost of providing sign language interpreters, captioning services, or assistive listening devices to ensure effective communication with individuals who are deaf or hard of hearing. It may also cover the expenses of providing materials in accessible formats, such as braille or large print, to accommodate individuals with visual impairments.

Architectural Barriers

Furthermore, expenses incurred for removing architectural barriers in existing facilities may be eligible for the ADA tax credit. This can involve removing physical barriers that prevent individuals with disabilities from accessing certain areas of a building, such as installing elevators, constructing accessible entrances, or retrofitting restrooms. The modifications must be directly related to improving accessibility and complying with ADA standards.

Exclusions: What Expenses Don't Qualify for the ADA Tax Credit

It is important to note that not all expenses related to ADA compliance qualify for the tax credit. For example, routine maintenance or repairs that do not improve accessibility would not be eligible. Additionally, expenses incurred for new construction or the purchase of land are generally not eligible for the ADA tax credit. It is advisable to consult with a tax professional or refer to the IRS guidelines to determine the specific qualifying expenses for the ADA tax credit.

How Much Can You Claim?

The amount that can be claimed with ADA tax credits depends on the specific expenses incurred for ADA compliance. The ADA tax credit is available to businesses that have made accommodations to meet the requirements of the Americans with Disabilities Act (ADA). The tax credit can be claimed for expenses related to removing physical barriers, providing accessible communication, and making modifications to facilities or equipment.

Credit Limits

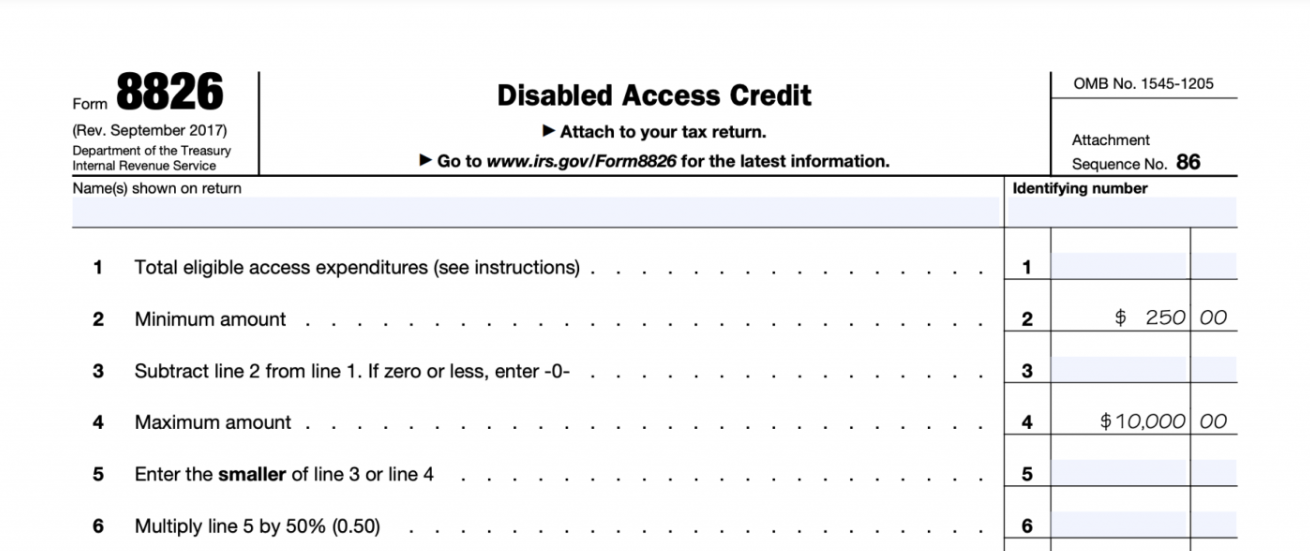

The ADA Tax Credit covers 50% of eligible expenditures over $250 but not more than $10,250. This translates to a maximum credit of $5,000 per year.]

For Example

If a business incurs $20,000 in eligible expenses for ADA compliance, they can claim a tax credit of $10,000 (50% of $20,000). However, if a business incurs $30,000 in eligible expenses, the maximum tax credit they can claim is $10,250, as it is the maximum limit set by the IRS.

It is important to note that the ADA tax credit is non-refundable, which means it can only be used to offset the business's tax liability. If the tax credit exceeds the tax liability for a particular year, the excess credit cannot be carried forward or refunded. Additionally, businesses must meet certain criteria and file Form 8826 to claim the ADA tax credit.

Combining With Other Credits

Yes, it is possible to combine ADA tax credits with other credits. The Americans with Disabilities Act (ADA) provides tax incentives to businesses that make their facilities accessible to individuals with disabilities.

Disabled Access Credit (DAC)

These tax credits can be combined with other federal and state tax credits, such as the Disabled Access Credit (DAC) and the Work Opportunity Tax Credit (WOTC), to further reduce the tax liability of businesses. However, it is important to note that each credit has its own eligibility criteria and limitations, so it is advisable to consult with a tax professional or accountant to determine the specific requirements and benefits of combining these credits.

Combining ADA tax credits with other credits can provide significant financial benefits to businesses. For example, the Disabled Access Credit (DAC) allows businesses to claim a tax credit of up to 50% of eligible expenses incurred to remove barriers and make their facilities accessible to individuals with disabilities. By combining this credit with the ADA tax credits, businesses can maximize their tax savings and promote inclusivity and accessibility in their establishments.

Work Opportunity Tax Credit (WOTC)

Another credit that can be combined with ADA tax credits is the Work Opportunity Tax Credit (WOTC). This credit provides incentives to businesses that hire individuals from certain targeted groups, including individuals with disabilities. By hiring individuals with disabilities and making their facilities accessible, businesses can potentially qualify for both the ADA tax credits and the WOTC, resulting in even greater tax savings.

It is important to note that the specific rules and regulations regarding the combination of ADA tax credits with other credits may vary depending on the jurisdiction and the type of credit. Therefore, it is crucial for businesses to thoroughly research and understand the requirements of each credit and consult with a tax professional to ensure compliance and maximize the available tax benefits.

Documentation: The Key to a Successful Claim

Documenting ADA tax credits is an important step in ensuring compliance with the Americans with Disabilities Act (ADA) and maximizing available tax benefits. Here are some key steps to consider when documenting ADA tax credits:

Step 1: Understand the ADA requirements

Familiarize yourself with the ADA regulations and guidelines to determine which tax credits may be applicable to your business. The ADA provides tax incentives for businesses that make accommodations for individuals with disabilities, such as removing architectural barriers or providing accessible facilities.

Step 2: Keep Detailed Records

Maintain thorough documentation of all ADA-related expenses, including invoices, receipts, and contracts. This documentation should clearly indicate the nature of the expenses, the date of the expenditure, and the specific ADA requirement being addressed. Detailed records will help support your claim for tax credits and provide evidence of compliance in case of an audit.

Step 3: Consult With A Tax Professional

ADA tax credits can be complex, and it is advisable to consult with a tax professional who specializes in ADA compliance. They can help you navigate the specific requirements and ensure that you are maximizing your eligible tax credits. They can also provide guidance on how to properly document and report these credits on your tax returns.

Step 4: Understand The Available Tax Credits

There are two main tax credits available under the ADA - the Disabled Access Credit (DAC) and the Barrier Removal Tax Deduction (BRTD). The DAC is available to businesses with annual gross receipts of $1 million or less, while the BRTD is available to businesses of any size. Understanding the eligibility criteria and requirements for each credit will help you document the appropriate expenses.

Step 5: Complete The Necessary Forms

When filing your tax return, you will need to complete the appropriate forms to claim ADA tax credits. For the DAC, you will need to file Form 8826, while the BRTD requires Form 8826. These forms will require you to provide detailed information about the ADA-related expenses and calculate the eligible tax credits.

By following these steps and maintaining proper documentation, you can ensure that you are accurately documenting ADA tax credits and maximizing the available tax benefits for your business.

Filing Your Claim

IRS Form 8826

To claim the ADA Tax Credit, you'll need to fill out IRS Form 8826. Form 8826 is a tax form issued by the Internal Revenue Service (IRS) in the United States. It is used to claim the credit for prior year minimum tax paid by corporations. In simpler terms, this form allows corporations to receive a credit for any alternative minimum tax (AMT) they paid in previous years. The purpose of this credit is to prevent double taxation by providing relief to corporations that were subject to AMT in the past.

To fill out Form 8826, corporations need to provide information about their prior year minimum tax liability, including the amount of AMT paid and any adjustments or preferences that may affect the credit calculation. The form also requires corporations to report their regular tax liability and any other credits they are claiming. By completing this form accurately, corporations can determine the amount of credit they are eligible to receive and reduce their tax liability accordingly.

It's important to note that Form 8826 is specifically designed for corporations and cannot be used by individuals or other types of entities. Additionally, this form is only applicable to prior year minimum tax and does not cover current year AMT liabilities. Corporations should consult the instructions provided by the IRS or seek professional tax advice to ensure they are correctly completing Form 8826 and claiming the appropriate credit for prior year minimum tax paid.

Filing Deadline

The filing deadline for IRS Form 8826 depends on the type of taxpayer. For individuals, the deadline is typically April 15th, which is the same as the deadline for filing individual income tax returns. However, if April 15th falls on a weekend or a holiday, the deadline is extended to the next business day. It's important to note that taxpayers can request an automatic six-month extension to file Form 8826 by submitting Form 4868 before the original deadline.

For corporations, the filing deadline for Form 8826 is generally the 15th day of the fourth month following the close of the corporation's tax year. For example, if a corporation's tax year ends on December 31st, the filing deadline for Form 8826 would be April 15th of the following year. Similar to individuals, if the deadline falls on a weekend or a holiday, the due date is extended to the next business day.

It's crucial to consult the IRS website or a tax professional for the most up-to-date information on filing deadlines for Form 8826, as they can vary depending on specific circumstances. Failing to meet the filing deadline may result in penalties and interest charges, so it's important to ensure timely submission.

In Summary

ADA compliance is not just a legal obligation but a way to promote equal access and inclusion for individuals with disabilities. By understanding the importance of accessibility, taking proactive steps to meet the standards, and continuously improving their practices, businesses can not only avoid legal consequences but also foster a more inclusive environment. Let us strive towards a society where everyone has equal opportunities and experiences, regardless of their abilities.

Join our newsletter

Recent Blog Posts